Global commodity markets are under pressure in 2025 amid rising trade tensions, US protectionism, and slowing global growth. Energy prices remain subdued, with oil at a 4-year low due to oversupply concerns and weak demand, while a stronger supply outlook for major crops is set to keep downward pressure on food commodity prices. Meanwhile, metals markets remain mixed, as policy-driven volatility curbs price momentum despite prospects for recovery later in the year.

Oil prices at 4-year low dragged by oversupply and weaker demand concerns

Heightened US protectionism, rising trade tensions and global policy uncertainty have dampened the global economic and industrial outlook, weighing on energy demand and prices. From January to April 2025, energy prices averaged 12% below the same period last year, largely due to falling oil prices.

The global economy is expected to slow further, with real GDP growth forecast at 2.9%, a downward revision from 3.2% projected in the previous quarter

Source: Euromonitor International

On the supply side, OPEC+ increased oil output in May and June, reversing previous voluntary cuts and pushing production ahead of schedule. Non-OPEC+ countries also continue to ramp up output, adding to concerns that oil supply growth will significantly outpace demand this year. This oversupply, combined with weakening demand, drove oil prices to a 4-year low in April. Going forward, prices are expected to remain under pressure, with key risks including shifts in US trade policy and OPEC+ output hikes.

In contrast, global natural gas prices surged in Q1 2025, driven by strong demand and supply disruptions in the US, where prices nearly doubled year-on-year. European prices also rose, though more moderately, amid low inventories. As of mid-May, European storage remained below the 5-year average, but rapid injections since April have set the region on course to meet its 80-90% fill target ahead of winter.

However, gas prices dropped in April following President Trump’s tariff announcement. While some reciprocal tariffs are paused, 10% blanket duties and partial tariffs on China, Mexico, and Canada remain, adding pressure to weakening global demand.

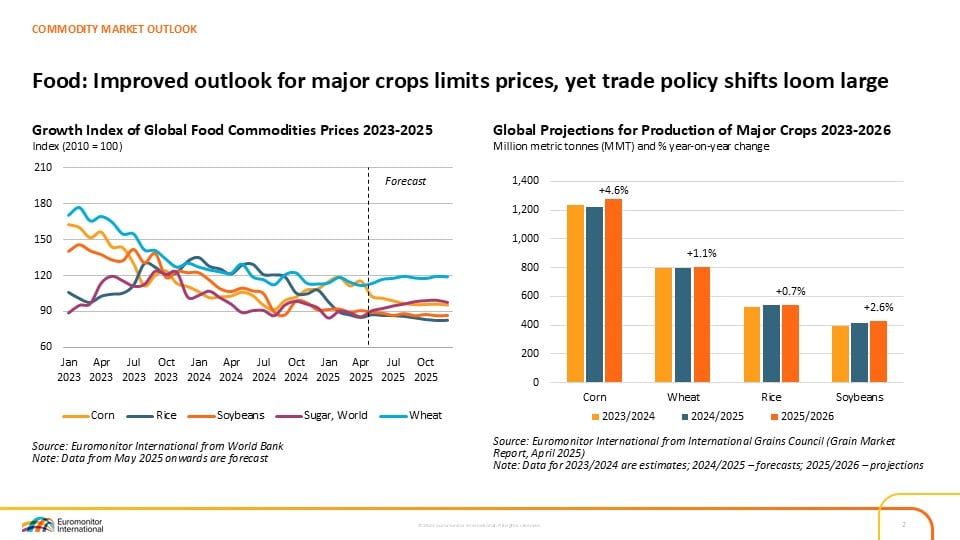

Food commodity prices face downward pressure amid strong supply and trade uncertainty

The agrifood price outlook is tilted to the downside driven by robust global output, softer export restrictions and a weaker economic outlook. Food commodity prices have declined year-on-year since early 2025, primarily due to falling grain prices amid mounting demand concerns. Favourable weather across key crop regions has further eased supply risks that previously supported prices.

Wheat prices have softened with improved supply expectations, though rising demand is expected to tighten the global market, adding upside pressure. In contrast, soybeans, corn, and sugar face downward pressure from anticipated market surpluses. Moreover, looser export controls in India are set to temper rice prices.

While US tariffs and retaliatory measures are currently paused, the potential reimposition of trade barriers in food commodities presents both downside and upside risks – dampening demand in some markets while disrupting supply in others. Meanwhile, extreme weather events and rising fertiliser costs pose notable upside risks.

US trade policy shapes metal prices in Q2 2025

Prices of key industrial metals showed a decline trend in Q2 2025, the result of changing US trade policy and the fear of trade wars. Additional US trade tariffs on China, in particular, hurt economic and manufacturing activities in China, which remains the world’s largest consumer of metals.

Industrial metal prices are forecast to pick up in Q3 2025, backed by easing of monetary policy in the largest economies and recovering activity in automotive, construction, and electronics sectors. Fiscal stimulus in the EU and anticipated improvements in manufacturing activity will also be among the positive factors. However, metal price growth throughout 2025 is forecast to be generally anaemic due to global trade uncertainty which impacts global economic growth.

Steel prices are forecast to show mixed trends throughout 2025. Steel prices in the US picked up in Q2 2025 due to higher trade tariffs which benefited domestic suppliers, while steel import restrictions in the EU and stable manufacturing output lifted steel prices in Western Europe. However, steel price growth is forecast to moderate throughout 2025 as high economic uncertainty hurts demand growth. Weak construction activity in China is also set to limit stronger steel price growth throughout 2025.

Read our latest Global Economic Forecasts: Q2 2025 report for more insights on the global outlook and potential implications of Trump’s policy on the global economy in 2025.